News

22 July 2016

Successfully completed the Global Offering of common shares of ENAV

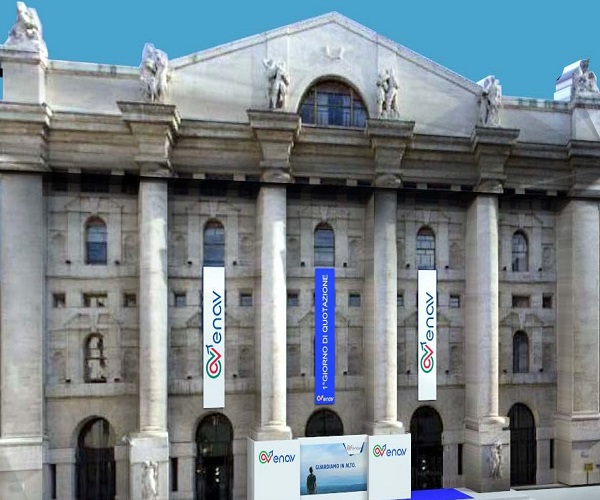

Enav in the Italian Stock Market

Tuesday, July 26, 2016 - 08,30 a.m.

Piazzale degli Affari, 6 - Milano

Enav in the Italian Stock Market

Tuesday, July 26, 2016 - 08,30 a.m.

Piazzale degli Affari, 6 - Milano

The Ministry of the Economy and Finance (the "Ministry") and ENAV S.p.A. (“ENAV” or the “Company”) announce completion of the Global Offering of ENAV's ordinary shares for the listing on the Mercato Telematico Azionario ("MTA") organized and managed by Borsa Italiana S.p.A.

The Global Offering offered up to 230 million ordinary shares, representing 42.5% of the Company's share capital (46.6% of the Company's share capital if the Greenshoe Option is exercised in full). The Global Offering included a public offering in Italy to retail investors and to the employees of the ENAV Group for a minimum of 23 million shares, representing 10% of the shares offered in the Global Offering, as well as a concurrent institutional offering.

Prior to the start of the Global Offering, the valuation range of the shares had been set from a minimum of € 2.90 up to a maximum of € 3.50 per share.

At the end of the offer period, the Offer Price, equal to the Institutional Price, has been set as € 3.30 per share, corresponding to a maximum aggregate value of € 759 million, gross of commissions payable in connection with the Global Offering and excluding the Greenshoe Option. In case the Greenshoe Option is exercised in full by the Institutional Underwriting Syndicate, the maximum aggregate value will be € 833.58 million.

The capitalization of the Company will be approximately € 1,788 million, calculated on the basis of the Price equal to Euro 3.30 per Share. In the context of the Global Offering, applications were received for an aggregate of 1,814 million Shares at the Offer Price.

Finally, aggregate demand, for 1,814 million Shares, was approximately 8 times the number of Shares offered in the Global Offering and approximately 7 times taking into account the Shares object of the Greenshoe Option.